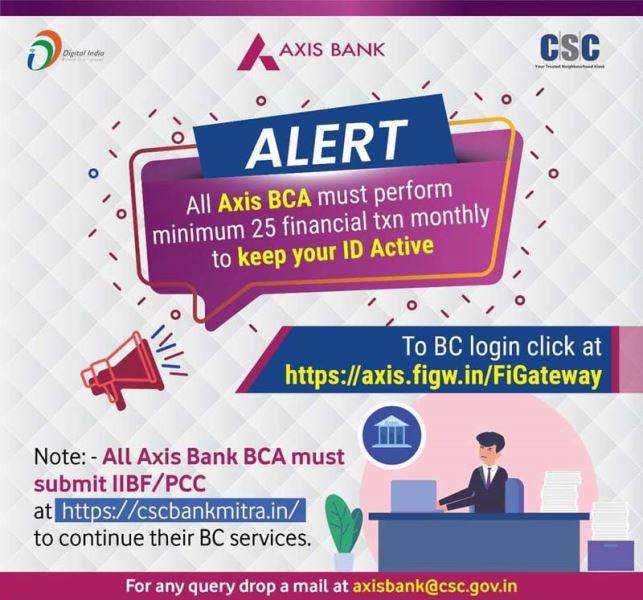

CSC Axis Bank Mitra: Axis Bank has recently announced new regulations for its Business Correspondents (BCs) in order to maintain their active status. According to the new guidelines! all Axis Bank BCs must perform a minimum of 25 financial transactions every month to keep their BC ID active. This move is focus on encouraging financial transactions in rural and remote areas and promoting financial inclusion.

CSC Axis Bank Business Correspondents New Guidelines

Axis Bank has been actively involve in promoting financial inclusion and digital financial services in the country. With this new mandate! Axis Bank BCs are required to perform a minimum of 25 financial transactions every month to keep their ID active. This will ensure that financial services reach more people in remote areas, and will help promote a cashless economy.

Article – Application for CSC Axis Bank BC Point 2023

The move towards digital financial services is gaining momentum in India! and Axis Bank is at the forefront of this initiative. The bank has also mandated that all CSC Axis Bank Mitra must submit their Indian Institute of Banking and Finance (IIBF) and Police Clearance Certificate (PCC)! at website https://cscbankmitra.in/ in order to continue their BC services. This platform will enable the BCs to upload their documents online! which will simplify the process and help streamline the documentation process.

Article- Axis Bank Banner PDF Download CSC

This new mandate is have a significant impact on the financial inclusion of the rural population. Many remote areas in India lack access to banking services, and this move by Axis Bank is focus on changing that. By encouraging more financial transactions! BCs will be able to bring banking services closer to the doorstep of millions of people in remote areas.

Article – CSC TEC Certificate Download PDF

This move also highlights the importance of BCs in promoting financial inclusion. BCs play a vital role in providing banking services in remote areas, and they are the backbone of the financial inclusion movement in India. By ensuring that BCs perform a minimum of 25 financial transactions every month! Axis Bank is promoting the importance of BCs in the financial ecosystem of the country.

Conclusion

The new mandate by Axis Bank for its BCs to perform a minimum of 25 financial transactions every month is a significant step towards promoting financial inclusion in India. By mandating the submission of IIBF and PCC certificates online! Axis Bank is simplifying the documentation process and making it easier for BCs to continue their services.