PM Kisan Credit Card : As you aknow! Our country is agrarian country! A lot of people in our country do agriculture. Many times they also have to suffer losses due to natural calamities! And they become indebted!

Keeping in view all these problems of the farmers, Kisan Credit Card has designed for the farmers! Farmers will get help financially through Kisan Credit Card. Agriculture sector by giving loans to farmers through this card. That is to meet the comprehensive financial needs!

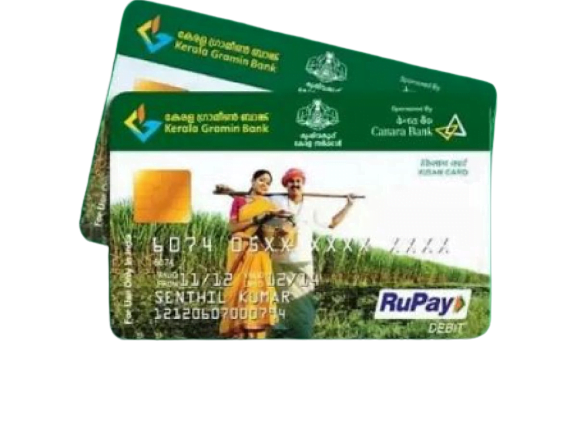

Kisan credit card is primarily designed for farmers only. Maximum benefit of this card will be given to the farmers only. Along with this, a passbook will get the farmers. In which the name of the farmer, credit limit, photo, validity of his land holding and details will be recorded.

Also Read – Death Certificate Apply Online

This card can be used for pesticides, seeds of high yielding varieties! And can do to buy agricultural products! And if you want, you can also use it to withdraw cash. The validity of this credit card will remain for 5 years. How many farmers are associated with the Prime Minister Kisan Yojana! He can take advantage of it.

If your card gets canceled due to any inconvenience. So you don’t need to worry about it! Because it can be restarted in very easy ways. If you have taken a loan through Kisan Credit Card. And you have already paid off the loan! So such farmers will get an extra 3% discount.

Also Read- CSC Poster Banner Download (Latest)

What are the Benefits Of Kisan Credit Card in 2022

There are many benefits of this card for farmers! The process of giving loans to farmers has become easy. 2% p.a. on loan of 3 lakhs within Kisan Credit Card. Interest subvention will be provided to the farmers. Loan up to 1.60 lakhs through this Kisan Credit Card. Provided without any guarantee.

Like I’ve already told! Whichever farmer pays off the loan at the earliest, ahead of time! So you will be given interest rebate at the rate of 3% p.a.! Apart from this, if you want to increase the validity of your card! So you can grow very easily through online medium!

Kisan Credit Card Eligibility and Important Documents

- Tenant farmers, sharecroppers, oral lessees etc. Take advantage of this card!

- Aadhar Card

- Pan Card

- Address proof

- land related documents

- passport size photo

- Tenant farmers, sharecroppers, oral tenants etc.

- Take advantage of this card!

- Aadhar Card

- Pan Card

- Address proof

- land-related documents

- passport size photo

Also Read – CSC VLE Whatsapp Group Link

What is the Application Process for Kisan Credit Card Scheme

- First of all you have to go to the website of that bank.

- Within which you want to apply for PM Kisan Credit Card Scheme.

- Then the home page will open in front of you.

- On this home page, you have to choose the option of Kisan Credit Card. Then you have to click on the option of Apply Online!

- After this, the Kisan Credit Card form will open in front of you. You have to fill all the information asked in this form carefully.

- After that you will click on the submit option. After this a reference number will be sent to you.

- If you are Elegibal, then the Bank will give you the information within 3 to 4 working days. Will contact you for further process.

You May Also Like This Posts

- CSC Aadhaar Operator Credential File Download

- DigiPay Deposit and Withdrawal Record Diary Download

- DigiLocker 6.8.7 Download For Android

- DigiPay Download

- CSC Voter Id Card Apply Services is Now Available on CSC Portal

- How to check the status of your CSC Center Application

- CSC TSSC Optical Fiber Splicing (OFS) Course

- CSC Kisok Bank Registration

- Rajasthan SSO ID Login | (SSO ID) How Register Rajasthan SSO ID

- New UPI Mode eRUPI Launches By PM of India

- CSC Telemedicine Service 2022

- CSC Digipay Sakhi Yojana | CSC BC Sakhi Registration

- DigiPay Deposit and Withdrawal Record Diary

- CSC Center Rate Chart List Download

- CSC PM Kisan EKYC Fingerprint Device Driver Download

- New Voter ID Apply Online : State Wise Voter Card Registration & Login

- NSDL PAN CSC LOGIN

- CSC NSDL PAN Services Live Now | CSC NSDL PAN Apply

- CSC Happy Republic Day 2022

- Yuva Pradhanmantri Yojana Apply Online 2022

- CSC Wallet Recharge by Using DigiPay